A note from Caroline: I was lucky enough to have Michael join as my Press Assistant last summer. As his role has grown here at Tanis Financial Group (TFG) it has been amazing to see his passion and skills for the TFG mission blossom. One of his hidden gems is his ability to write and really dive into a topic. It is my honor to bring to share his writing today as he covers the topic of money dysmorphia.

Social media is bad for your brain.

Recent polls indicate that over 1/3 of Americans are concerned about the threat that social media poses to mental health. Yet, despite our collective consensus, we spend a daily average of two-and-a-half hours using social media, which amounts to nearly four years over a lifetime. Yikes… If we’re so concerned about the dangers of social media, then why do we doom-scroll for hours on end? Are we willingly subjecting ourselves to this self-inflicted abuse, or have our devices stripped us of free will? Have we become a society of self-loathing tech-masochists or helpless tech-addicts, which would you call it?

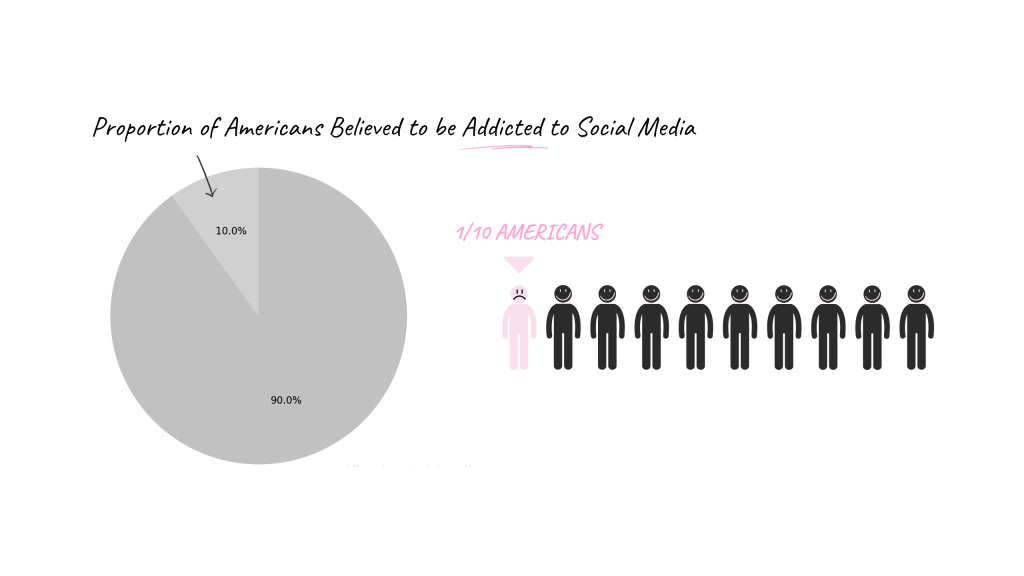

{ 33.19 million Americans are believed to be addicted to social media }

DYSMORPHIA

Of the many harmful effects of social media, perhaps none other is as damaging and prevalent as dysmorphic disorder. This mental health condition leads an individual to compulsively critique one or more perceived defects or flaws in their appearance, social standing, or identity––perceived flaws that are unwarranted and not based in reality. Dysmorphic disorder distorts the self-image, convincing healthy bodies that they’re grossly out of shape, straight smiles that they’re crooked beyond repair, and, for the sake of this article, well-earning individuals that they’re somehow underachieving financially. In the past two decades, as social media addiction rates have surged, so too have cases of general dysmorphic disorder––do I dare claim a positive association?

EXPOSURE

In advertising, the rule of seven suggests that a consumer will become familiar with a brand, and make a purchase, after seven exposures (ads, billboards, commercials, etc). This principle can also be applied to social media, where a high volume of exposure to content builds familiarity between a user and whatever is being projected to them. For instance, a commuter repeatedly passing by a billboard advertising Marlborough Reds is expected to become familiar with the Marlborough brand and purchase a cart. However, for an Instagram user scrolling through images of expensive skincare and synthetically flawless complexions, familiarity is not established with a product, but with an unattainable image. The commuter can purchase the cigarettes being advertised to them, while the Instagram user is left wanting something they cannot have… because not only is it intangible, it does not exist.

Social media has become a macrocosm of hyperbolized appearances, body types, and lifestyles. Given the role that technology and social media play in our day-to-day lives, it should be common knowledge that such portrayals are often exaggerated and carefully sieved to conceal semblances of hardship, struggle, or failure. However, when users spend more time on social media than they do in the real world, the line between the two becomes blurred. Inundated by influencers with toned bellies and zero percent body fat, a user can quickly begin to believe that such physiques are the status quo. But they are not. Everyone on Instagram may have glossy skin, luminescent teeth, and six-pack abs, but not everyone in the real world does.

INSECURITY

Financial insecurity in America is at an all-time high, with more than 62% of homeowners struggling to make their mortgage payments on time, and over half of renters saying that purchasing a home is something they find unaffordable, undoable, and flat-out unimaginable. To cap it off, our homeless population has risen by 12% in the last two years, with over 653,100 people now believed to be living in shelters, outside in tents, or in their cars. We are living in one of the most financially insecure periods in American history, rivaling recessions and depressions of days past. All the while, during this time of mass financial insecurity, we’re spending unhealthy amounts of our time scrolling through social media applications, which are known to prey on and exacerbate the insecurities of users. Smells like the perfect recipe for money dysmorphia to me.

MONEY DYSMORPHIA

While there’s an abundance of research linking social media use to body dysmorphic disorder (BDD), there’s less known about the psychological impact that social media has had on working professionals. If Instagram can convince a generation of body-insecure teens that they’re physically inadequate, what can it convince a generation of financially insecure adults of? Money dysmorphia, a concept recently brought to life by CNBC reporters Jessica Dickler and Ryan Ermey, is the distortion of an individual’s perception of their financial status, career trajectory, and/or general money identity. Like other dysmorphic disorders, money dysmorphia is most prevalent in individuals with a predisposed insecurity––and who’s more financially insecure than a recent college graduate? Gen Z, the age demographic consisting of our mid-twenty-something-year-olds just beginning to settle into their careers, has been hit by money dysmorphia the hardest. Members of Gen Z are 5 times more likely than adults aged 40 and above to receive financial advice from social media, which is why it’s crucial for online finance influencers to publish content that is both accurate and informative. Thank god there remain the chosen few who actually adhere to both, wink wink.

{ 43% of Gen-Z and 41% of millennials feel as though they are “behind financially” while only 14% self-identify as “wealthy” }

TOXIC

Social media has become saturated with Jordan-Belfort-wannabe salesmen like @officialandyelliot, scoffing at the notion of making anything less than 250k a year despite less than 30% of Americans having ever broken the 100k/year mark––which is in itself a major accomplishment. Just as the rule of seven suggests, repeated exposure makes a consumer familiar with a product or brand. Given social media’s profusion of lavish lifestyles, super yacht walkthroughs, and Tahitian excursions, it’s no wonder how users have become so familiar with inflated portrayals of the world, and, in turn, had their perceptions of real life distorted. In the real world, hard-working men and women earning a steady paycheck should be commended and made to feel proud of themselves. On social media, skipping university and becoming a self-made drop shipper is the “quickest and easiest way to make seven figures by age 21!”

Being a young professional with a presence on social media, I’ve personally fallen victim to the comparison complex that comes as a result of high social media usage. In the past I would downplay my achievements, seeing little to be proud of when compared to the achievements of strangers online. When I graduated from university, there wasn’t much to be proud of, not when some seventeen-year-old in Miami was making 25k a month day trading, or something of that matter. Under the guise of hyper-success, I came to hold a general feeling of discontent and impatience with how long my path to success was taking. I had fallen into the same bucket as 1/4 of Americans who admit to being obsessed with the concept of “becoming rich” and the 52% who doubt that they’ll ever attain such wealth. Had TLC taught me nothing? You cannot go chasing waterfalls, or, whatever social media tells you waterfalls are.

{Approximately 1/4 of American consumers say they feel “less satisfied with the amount of money they have because of social media”}

BENCHMARKS

It can become incredibly easy to believe that you are standing small when measuring yourself up to those on stilts. Social media is no more than a human highlight reel and far less than an accurate reflection of daily life. The benchmarks we set for success are where we set them for ourselves, not where Instagram sets them for us. Those American Income videos, where super-wealthy attorneys and anesthesiologists working in Manhattan are flagged down and asked to share how much money they make in a year, that’s not the benchmark. Those “how much do you pay in rent” videos, which are almost exclusively shot in major metropolitan cities where the cost of living is exorbitantly high, that’s not the benchmark. Those “here’s my day working in [INSERT ROLE]” videos, where a corporate-higher-up-by-day & influencer-by-night offers a private tour of his/her company’s Michelin-star lunchroom, that’s not the benchmark. Horseback riding on the beaches of Bali. Retiring as a multi-millionaire by age twenty-five. Eating wagyu steak and eggs for breakfast. None of this is the benchmark. The benchmark is where we set it for ourselves, at least, that’s where it should be…

GRACE

Social media may have convinced you that you’re not achieving enough, earning enough, or doing enough by such and such age, but TikTok & Instagram don’t know about all of your big and little wins. They don’t know about all those weekends you spent working to pay off your student loan debt. They have no idea about that vacation you saved up for and all the memories you made on it. The time you purchased your first car. Your first home. That anniversary gift you bought your parents after landing your first salary position. Your money wins are uniquely your own and are something you should be proud of––indicators of a life’s worth that social media could never appraise.

I’m not huge on cliche adages, but there’s one that rings particularly true in today’s digital age… comparison is the thief of joy. You are the architect designing your own dream life, don’t let outside influences convince you to scrap the blueprint all together. Stay on the path toward your goals and focus on what’s ahead of you, not on the screen beneath you. Give yourself time to reach your goals, even if it only took a 19-year-old real-estate-guru one year to make their first million. Give yourself grace when you stumble, because people online stumble too, they just don’t tell you about it. Above all else, do your brain the favor and stay the hell off of social media.

-MA

Michael A. Ruotolo is the Director of Marketing at CareMEDICA and the Press Assistant for Caroline Tanis. He writes on a variety of topics, including politics, market trends, pop culture, and current events. For inquiries, email michaelanthonyruotolo@gmail.com