If you haven’t noticed my theme this month has been centered around preparing for 2024. And in writing these posts each week, I have been reflecting on the commonalties I saw with clients and prospects this year. Today I have another question to pose to you based on many of these conversations- do you know your investment goal?

I sat down with a prospective client and her new husband over the summer for their discovery call. If you haven’t gone through the financial planning process, this is the call in which we dissect ALL and I mean all of your finances. We also unpack what your financial goals are. Part of that is narrowing down how much your goals will cost.

During our discovery call the newlyweds mentioned one of their 3-5-year goals is to buy a home up in the suburbs of Connecticut. So, I asked them what type of homes they were looking for and what that type of home cost in the towns they really liked. My goal in asking these questions is to back into the equation- if we know how much we need and how much we have we can figure out what financial steps to take from there.

They had no idea. Not even a rough estimate of what homes cost in their dream neighborhood. Now, don’t be thrown, this happens all the time. I sit down with so many people and I ask them how much their dream vacation is, what they want to spend during retirement, or on their second home. And a majority of people have no clue.

To take a step back we aren’t talking about what they can afford (yet). We are talking about what their next dream home, car, or lifestyle change looks like. From there, we dive into how realistic that dream is and what steps would need to be taken to make it a reality. But most people are stumped on question one- how much does that cost?

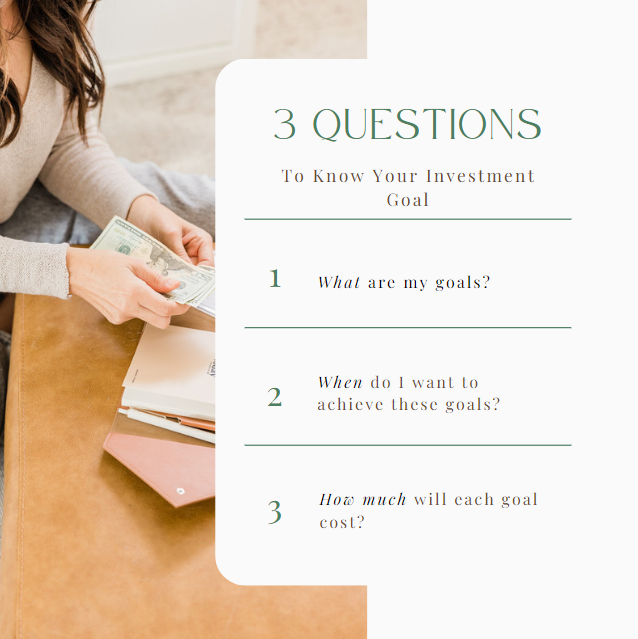

If you have no idea how much something costs how do you know what your investment goal is? When working with my clients I help them calculate an investment goal but if you are choosing to build a financial plan on your own here are the three biggest questions to ask yourself

From there, it’s time to build a plan to make those dreams into a reality. Ready to build your financial plan? Schedule an introductory all today to learn more.

All financial planning and investment advisory services offered through Women’s Wealth Boutique, a Registered Investment Advisor with the States of New Jersey, Ohio, Colorado, South Carolina, Michigan, Alabama, Indiana, and Virginia.